Editorial

Between May and September of 2020, we saw what would come to be known as “DeFi Summer” play out with the popularization of liquidity mining and yield farming. This period set the stage for leaders like Uniswap, Compound, Aave, Yearn Finance, and Synthetix to emerge, all while Ethereum was getting increasingly congested by ever more frantic games of musical chairs (looking at you, $PASTA). Eventually, the mania subsided, followed by a short bear stint through October that washed out most of these projects - but the rest is history.

What characterized DeFi Summer 1.0 was the perfect combination of new and existing mechanisms that caught the market’s imagination. Liquidity pooling and mining, as well as yield aggregation, all existed in some capacity prior to this period, but it was the normalization of these concepts by well-regarded projects (i.e., the launch of Compound Finance’s governance token) that resulted in this explosion of activity. Now that we find ourselves nearing its one-year anniversary, a similar set of conditions is coming into view.

DeFi Summer 2.0 will be the direct result of the competition between an increasingly crowded landscape of Ethereum layer-two solutions. Two factors come into play here:

New User Behaviors: Layer-two solutions offer the promise of low gas fees without the need for leaving behind the existing DeFi ecosystem on Ethereum. Certain behaviors that were out of reach for the average user on Ethereum mainnet, like intraday compounding or yield farm reallocation, now become table stakes for even the smallest of minnows. For more advanced users, reduced friction will result in the growth of high(er)-frequency prop trading.

Land Grab for Market Share: Just as it was unclear last summer whether specific DeFi verticals would be winner-take-all (they were not), users will seek to speculate on which specific layer-two solutions are to become the market leaders. Between commit chains, optimistic rollups, and zero-knowledge rollups, there are enough debates to fuel this land grab narrative. Users will be able to do so either through the governance tokens of some of these solutions (e.g., Polygon, DeversiFi) or by those associated with projects building on top of them. Uniswap’s decision to deploy v3 on Arbitrum, rather than only bridging to Optimism, gives us a hint as to how the market will come to assess the moat of any given DeFi app (multi-chain or die).

Just what exactly will spark this powder keg remains in question. Two further things to consider are that, a) Binance Smart Chain and Solana have both seen DeFi manias in their own right this year, and b) Polygon is already nearing some $10B in TVL - perhaps summer is already upon us? And to throw in another wild card, parachain auctions for EVM-compatible networks on Kusama and Polkadot could provide new speculative capital as well. My view is that there are enough catalysts floating in this ecosystem that the difference between DeFi TVL melting up for the remainder of 2021 versus growing some 5-10x could once again simply be one project discovering a template flywheel.

Bringing it back to BarnBridge: I’m excited to see how new user behaviors emerge with our Aave integration on Polygon in the coming weeks. Without the gas fee friction, users will be able to lock in fixed rates with our senior tranches with shorter tenors, regardless of their principal size. For example, a user with $1,000 could profitably spend a year rolling over senior bonds with weekly durations while retaining optionality. There’s another use case relevant to layer-two that I’m excited about, but it’s part of a larger SMART Yield expansion we’re looking into and so I need to stay mum about it for now. 😉

Happy US holiday weekend,

- Max

Governance

This week saw the successful passage of DAO votes 2 and 3, provisioning incentives for the Aave and C.R.E.A.M. Finance SMART Yield markets, as well as seeding a number of community initiatives. The following items will be up for discussion over the coming month:

Integrations Team Renewal: The Integrations Team has been live since the beginning of April and so we’ll look to have a community review in the lead up to July 1st. I’ll be providing a recap and breakdown of what we’ve been working on with them, as it’s been relatively behind the scenes.

Polygon Rewards: With Aave on Polygon boasting over the $6B in TVL, we’ll need to consider how we go about incentivizing liquidity here. It’s nuanced because we have no clue what user behaviors will look like there, as alluded to above.

Existing Reward Reallocation: Along those same lines, we’re getting close to rethinking how we go about incentivizing the junior tranches that are allocated rewards today. You can expect a forum discussion in the coming week to elaborate on this, but essentially, it would move existing rewards to users who make secondary markets for the jTokens.

Also, if you haven’t yet, make sure to take Mike987’s survey if you’re interested in there being a feature for claiming all BOND earned across pools.

Lastly, I had the chance to speak on Chainlink Live this week. You can view the AMA below.

Key Metrics

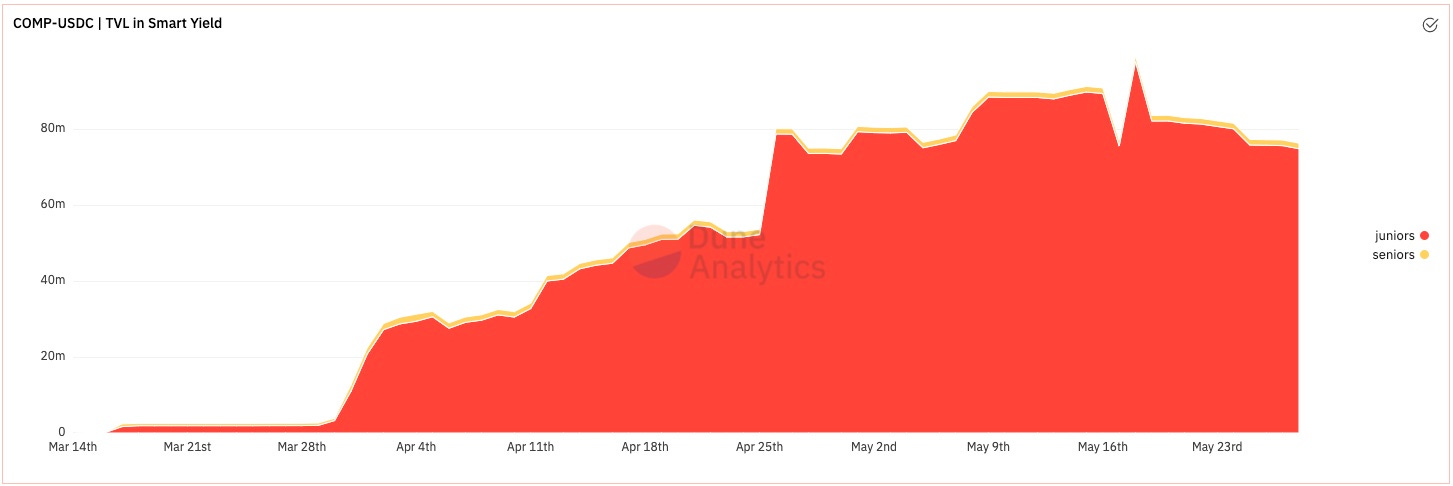

Amidst the market turmoil, we saw declines in our Compound USDC originator TVL as rates declined and, presumably, folks were interested in #buyingthedip. Not much else to report here aside from a) 0xBoxer is working on upgrading the dashboard to encompass all other originators, and b) we are working on junior and senior secondary liquidity, as well as smart contract insurance options for both tranches, in order to address the user feedback we’ve received. You can expect progress to be made on the insurance front within the next week.

On SMART Yield

On USDC/BOND Uniswap v2 Liquidity and DAO Liquidity

Disclaimer: BarnBurner is not an official BarnBridge publication and is not meant to reflect the shared views of its core team or BOND token holders. BarnBurner is an educational weekly newsletter meant to share updates on technical and governance-related happenings that occur within the BarnBridge ecosystem. The content herein is not financial advice and readers should not base any investment decisions off of it.

Thanks to Zach Owens for his branding work, and 0xBoxer for their dashboards 🤝